vermont sales tax on alcohol

Alcoholic Beverage Sales Tax. SNAP or food stamps are exempt from sales tax.

Vermont Income Tax Calculator Smartasset

The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on.

. However alcohol excise taxes recently went up about 150. Liquor sales are only permitted in state alcohol stores also called ABC Stores. Sales Tax A sales tax of 6 is imposed on the retail sales of.

Therefore the total excise tax on spirits is 2630 per gallon. Effective June 1 1989. The Essex Junction Vermont sales tax is 600 the same as the Vermont state sales tax.

For beverages sold by holders of 1st or 3rd class liquor licenses. Vermont is an Alcoholic beverage control state in which the sale of liquor and spirits are state-controlled. Average Sales Tax With Local.

The tax rate is 6. To learn more see a full list of taxable and tax-exempt items in Vermont. The second is an excise tax which us 27 cents per gallon of beer and 55 cents per gallon of wine.

On top of the state sales tax there may be one or more local sales taxes as well as one or more special district taxes each of which can range between 0 and 1. Vermont Liquor Tax 15th highest liquor tax. Vermont Business Magazine After many years of delay the Federal Motor Carrier Safety Administration rolled out Entry Level Driver Training Regulations on February 7 2022While not retroactive these regulations require that any new entry-level commercial drivers complete an FMCSA-approved driver training program ending the ability of drivers to learn more informally.

While Vermonts sales tax generally applies to most transactions certain items have special treatment in many states when it comes to sales taxes. Skip to main content. Restaurants are charged at a 9 sales tax rate plus a 1 local sales tax in certain cities and all alcoholic beverages have a 10 sales tax rate plus a 1 local sales tax in certain cities.

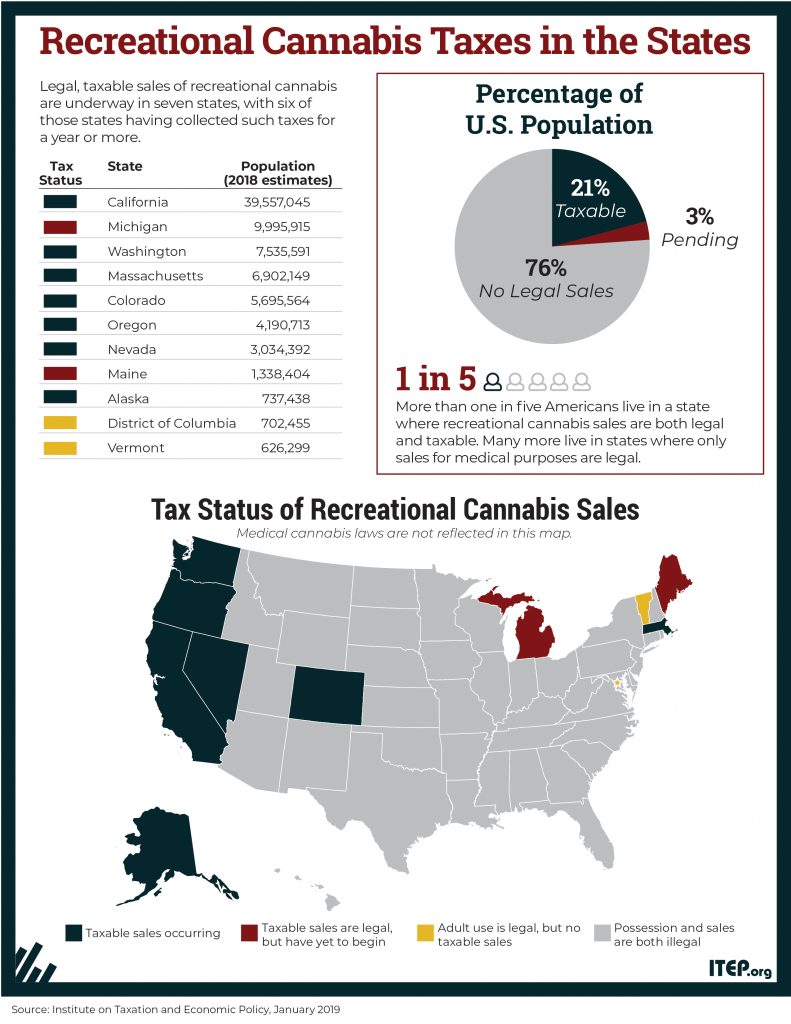

Chapter 233 The sales and use tax is imposed on alcoholic beverages sold at retail that are not for immediate consumption. 45 rows The sales tax rate is 6. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

Vermont has a statewide sales tax rate of 6 which has been in place since 1969. The best way to determine whether a beverage falls under the definition of a soft drink is to read the product label. In addition to or instead of traditional sales taxes gasoline and other Fuel products are subject to excise taxes on both the Vermont and Federal levels.

Excise taxes on Fuel are implemented by every state as are excises on alcohol and tobacco products. The Vermont excise tax on liquor is 768 per gallon higher then 70 of the other 50 states. There are a total of 153 local tax jurisdictions across the state collecting an average local tax of 0156.

In Vermont this is the 3SquaresVT program. Vermont state sales tax. Vermont sales tax reference for quick access to due dates contact info and other tax details.

The state of Alaska adds an excise tax of 1280 per gallon of spirits. Manage beverage alcohol regulations and tax rules. Vermonts general sales tax of 6 does not apply to the purchase of liquor.

Vermont first adopted a general state sales tax in 1969 and since that time the rate has risen to 6. All hard liquor stores in Vermont are state-owned so excise taxes for hard alcohol sales are set by the Distilled Spirits Council of the United States DISCUS. 12 - Kentucky Sales Tax Exemptions Kentucky doesnt collect sales tax on purchases of most prescription drugs.

We have provided a table to help guide you on page 2. Vermont has state sales tax of 6 and allows local governments to collect a local option sales tax of up to 1. See definition at 32 VSA.

It also adds an excise tax of 107 to beer and 250 to wine. Sales tax region name. Direct Ship to Retail.

Vermont has recent rate changes Fri Jan 01 2021. Learn more about Vermont Sales and Use Tax. Sess 283 eff.

Alaskans are free of sales taxes. Counties and cities in Vermont are allowed to charge an additional local sales tax on top of the Vermont state sales tax with 10 cities charging the additional 1 local sales tax. Contain one-half of 1 or more of alcohol by volume are subject to the 6 Vermont Sales and Use Tax.

Or lengthens the period specified by proclamation as provided in Vermont Statutes Annotated Title 1 Section 431 and such time of day shall be construed to mean US. Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. The sales and use tax is also imposed on many of the items purchased and used by businesses although some items are exempt from tax.

Sales tax is a tax paid to a governing body state or local on the sale of certain goods and services. Vermont sales tax reference for quick access to due dates contact info and other tax details. Sales and Use Tax 32 VSA.

Vermont Alcoholic Beverage Sales Tax 87238 KB File Format. Alcoholic Beverage Sales Tax. With local taxes the total sales tax rate is between 6000 and 7000.

Permitted sale of liquor on Sundays. Liquor sales are only permitted in state alcohol stores also called ABC Stores. Vermont sales tax on alcohol Sunday March 6 2022 Edit Excise taxes on alcohol are implemented by every state as are excises on cigarettes and motor fuels like gasoline.

The state sales tax rate in Vermont is 6000. Vermonts excise tax on Spirits is ranked 15 out of the 50 states. Note that in some areas items like alcohol and prepared food including restaurant meals and some premade supermarket items are charged at a higher sales tax rate than general purchases.

Tax rates last updated in April 2022. This page describes the taxability of occasional sales in Vermont including motor vehicles. Certain purchases including alcohol cigarettes and gasoline may be subject to additional Vermont state excise taxes in addition to the sales tax.

Select the Vermont city from the list of popular cities below to see its current sales tax rate. The tax rate is 6. If you are a new business go to Getting Started with Sales and Use Tax to learn the basics of Vermont Sales and Use Tax.

Vermont Use Tax is imposed on the buyer at the same rate as the sales tax. The state earns revenue by selling alcoholic beverages so there is no need to apply an additional excise tax on.

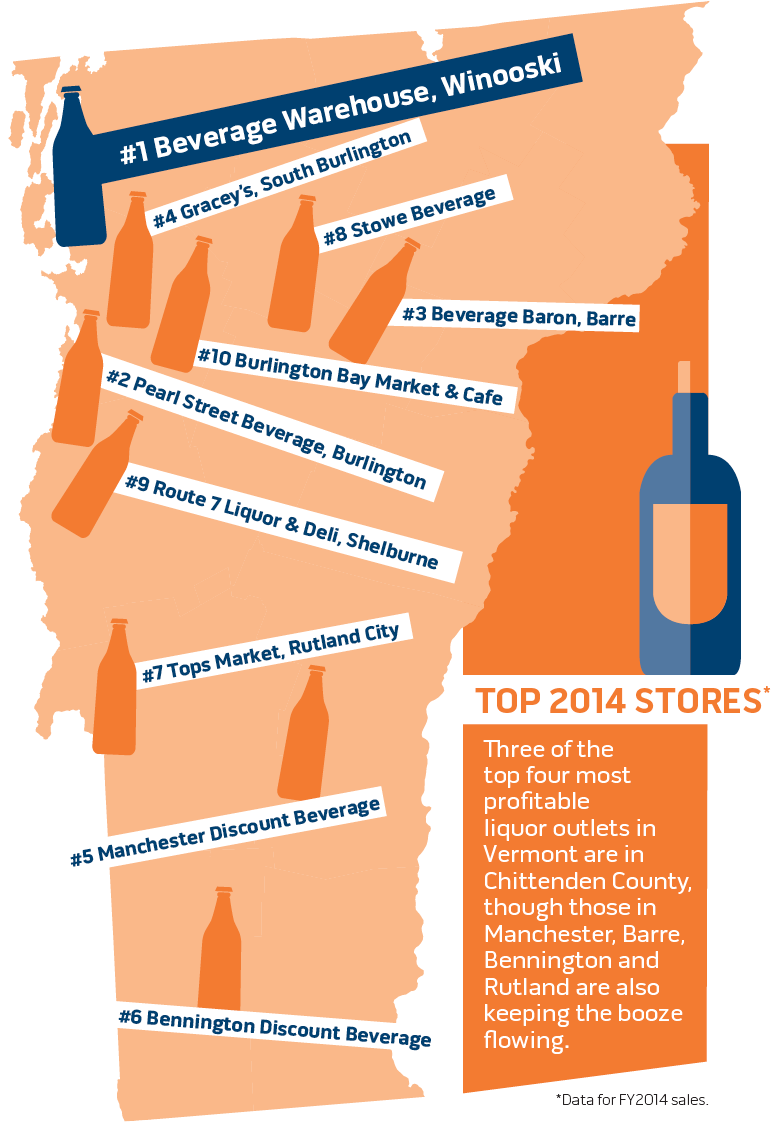

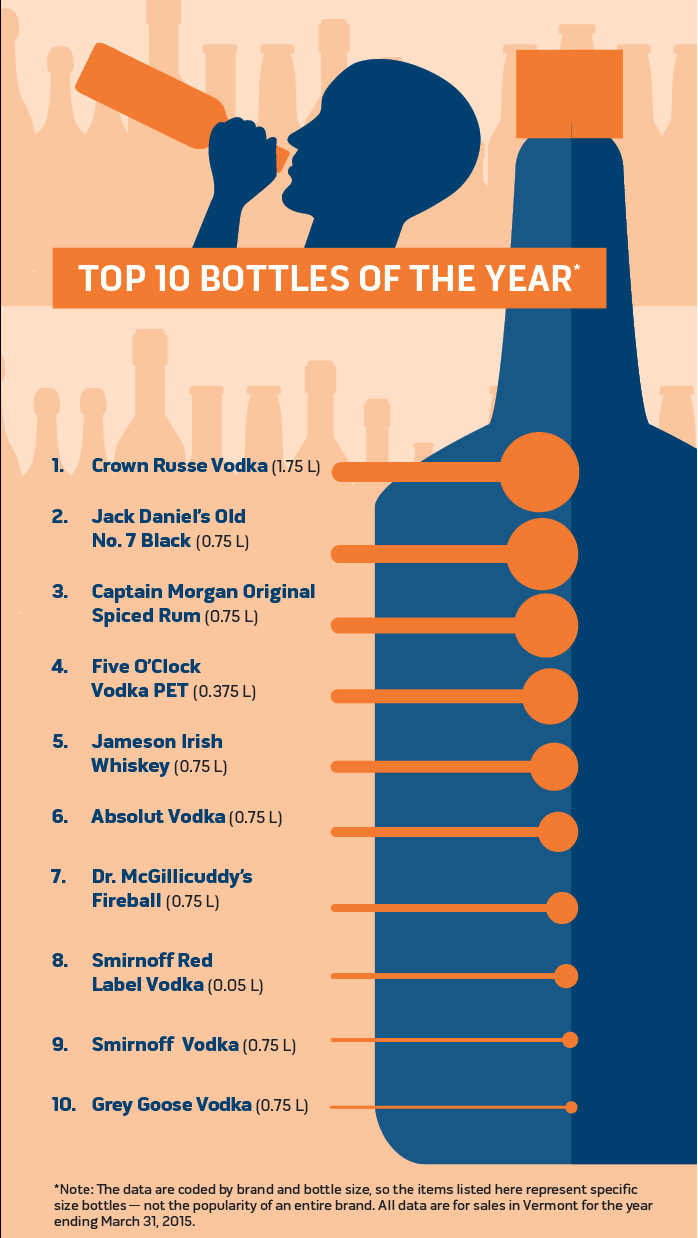

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Which States Have The Lowest Property Taxes Property Tax Usa Facts American History Timeline

Discover 14 Of The Most Fun And Interesting Facts On Vermont Economic Ones Too

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Income Tax Vt State Tax Calculator Community Tax

Liqour Taxes How High Are Distilled Spirits Taxes In Your State

States With Highest And Lowest Sales Tax Rates

Vermont Income Tax Vt State Tax Calculator Community Tax

Vermont Cigarette And Tobacco Taxes For 2022

Vermont Mulls Pros And Cons Of Privatizing Liquor Sales Business Seven Days Vermont S Independent Voice

Alcohol Taxes On Beer Wine Spirits Federal State